Compare the number of items sold to your monthly sales figures to make sure your inventory tracking sheet matches actual sales. I found the grammar to be very clear, concise and very effective. The textbook is very clearly divided into separable modules, making it easy for both students to read and for instructors to choose which modules to include in their course. With respect to comprehensiveness- the text book is very comprehensive.

Feeling bogged down by repetitive processes and redundant work?

- You can download the paper by clicking the button above.

- Any changes made to accounting principles, Canadian or International, will be very easy and straightforward to update.

- This organization facilitates a smooth flow of information, helping readers understand the material progressively.

- Key concepts are appropriately highlighted, and the inclusion of relevant examples and illustrations further enhances clarity.

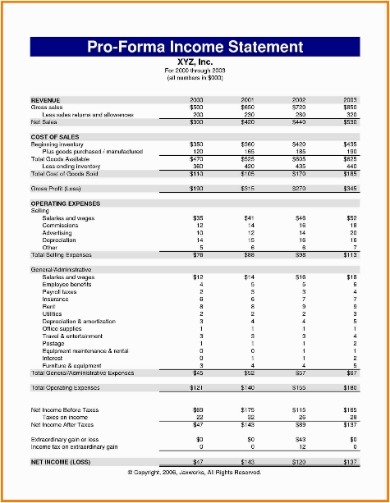

- This budget template includes tabs for recording income, expenses, and cash flow.

For example, a chapter on Fraud, Internal Controls, and Cash has seven subsections; one on Petty Cash and another one on Bank Reconciliations. If you want to end of year bookkeeping concentrate on one or more of these topics rather than the entire chapter, it is very easy to do. This also makes the reading more comprehensive and easier for the students who cannot finish the reading assignment at one time. The topics are organized along the same lines as best-selling financial accounting textbooks.

Types of Bookkeeping Accounts Used To Organize Income and Expenses

The accounting framework is used consistently to measure, recognize, present, and disclose the information appearing in financial statements. Instructors can rely on up-to-date accounting information, but unlike purchased publisher textbooks, these are not replaced every other year. Any significant accounting changes will be updated and the examples will not be outdated. It follows the order of most other similar texts – accounting cycle, accounts, financial statements, and lastly – financial statement ratios and analysis. This trial balance worksheet compares beginning and ending balances on each of your financial accounts based on debit and credit transactions over a given period.

Billing Invoice Template

No, there are not quizzes, homework assignments, or in-class work available. Supposedly, these materials exist in the user community, yet I was unable to locate interim financial statements or obtain them. This remains a stumbling block (in my mind) to adoption. Basic principles are introduced in the proper sequence, and the authors clearly present the topics in the expected manner. A cursory review of the text, examples and end of chapter material did not reveal any inaccuracies or errors. Chapters are divided into smaller segments, which accommodates different lengths in courses well.

Month Cash Flow Forecast Template

The book contains 13 chapters – more than enough for a college semester of weeks. It covers the accounting process, accounts, journal entries, ledgers, financial statements, financial statement analysis, and types of business entities, among others. These are topics usually seen in any other financial accounting textbook. There are chapter summaries, discussion questions, exercises, and problems with solutions for each chapter. It contains excellent explanations of concepts such as the differences/similarities between revenue and gains.

Track business expenses such as transportation, entertainment, lodging, and meals with this expense report template. Specify the time frame at the top of the spreadsheet and list all expenses with dates for each transaction. The template provides space to add notes or detailed descriptions as needed.

I reviewed this textbook in a pdf format, but it is also available online and in an ePub format. I found it extremely easy to navigate as there are links to each Chapter and each learning objective in the table of contents. There are many tables, charts, illustrations, and example financial statements that are easy to read and help the reader to better understand the material. This textbook covers all the topics that are typically taught in a principles offinancial accounting course.

These forms are useful as templates for self-employed people or treasurers of clubs, or small start-up businesses who are keen to maintain a complete or partial manual bookkeeping system. Written in order to directly meet the needs of her students, this textbook developed from Dr. Christine Jonick’s years of teaching and commitment to effective pedagogy. I found the textbook to interface well in the pdf format. The material is technical, and the examples are free of cultural bias.

I felt the chapters were quite comprehensive, even touching on some topics that are included in intermediate accounting textbooks. I only have a few notes when comparing this textbook to when is the best time to incorporate your business other introductory financial accounting textbooks. Most introductory financial accounting textbooks I have seen have separated the adjusting process into its own chapter. This textbook combines adjusting entries, financial statements, and closing entries into one chapter; but it covers it all well. There is only a brief mention of internal controls with no mention of the Sarbanes-Oxley Act.